Cool Info About How To Lower Your Tax Bracket

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to.

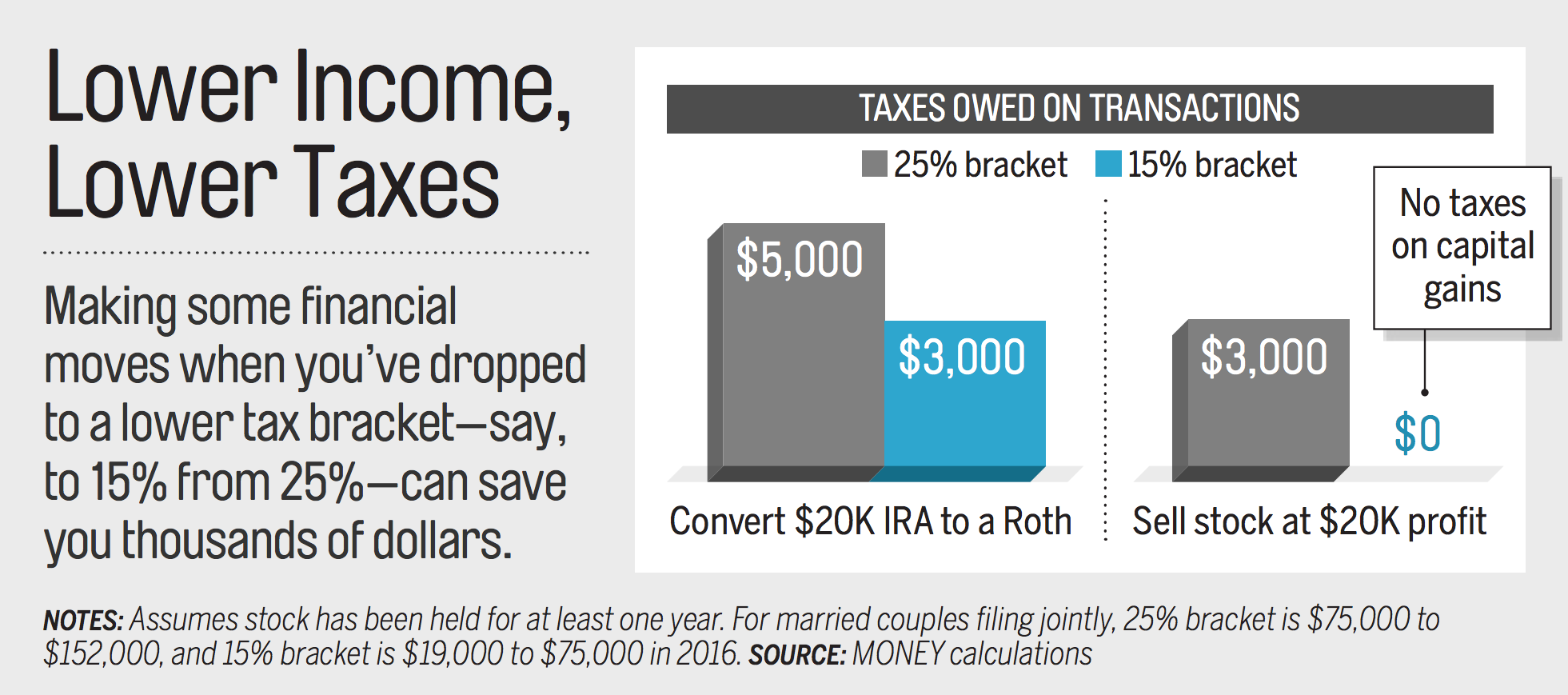

How to lower your tax bracket. Consider these five ways to avoid spiking into a higher tax bracket this year: Here are 5 ways to reduce your taxable income 1. Otherwise there are plenty of homes in most areas that.

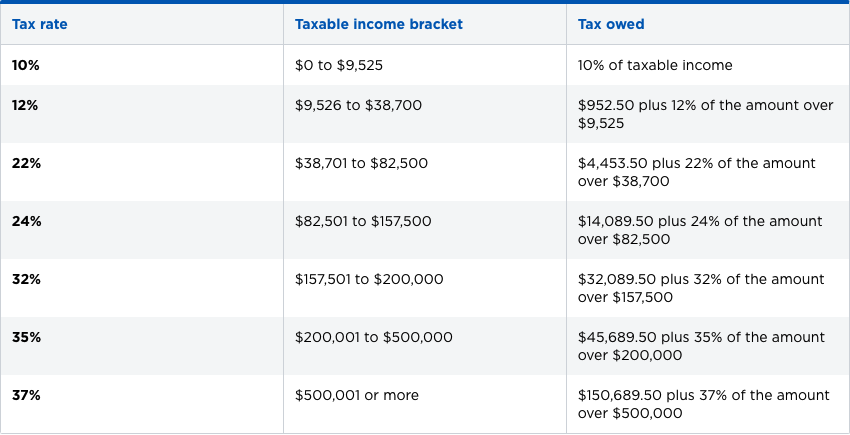

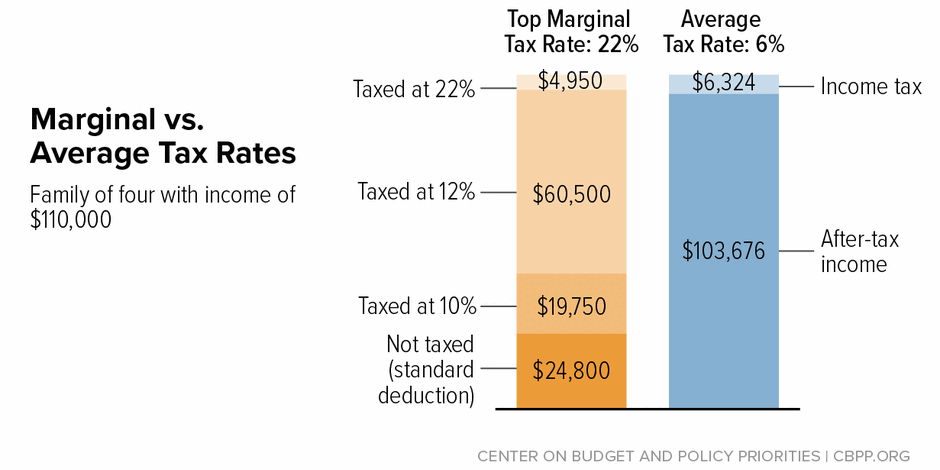

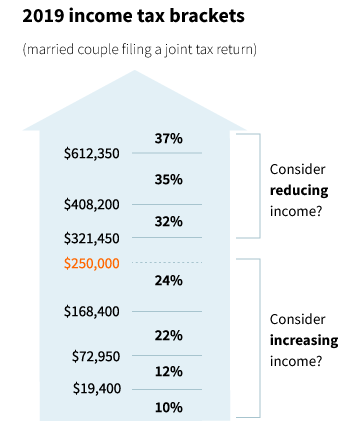

A worker in the 24% tax bracket who maxes out this account will reduce his federal income tax bill by $1,440. The more deductions you have, the less tax you'll pay. Married couples who file joint tax returns have a 2022 standard.

How can i lower my tax bracket? So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220. How can i reduce my taxable income in 2021?

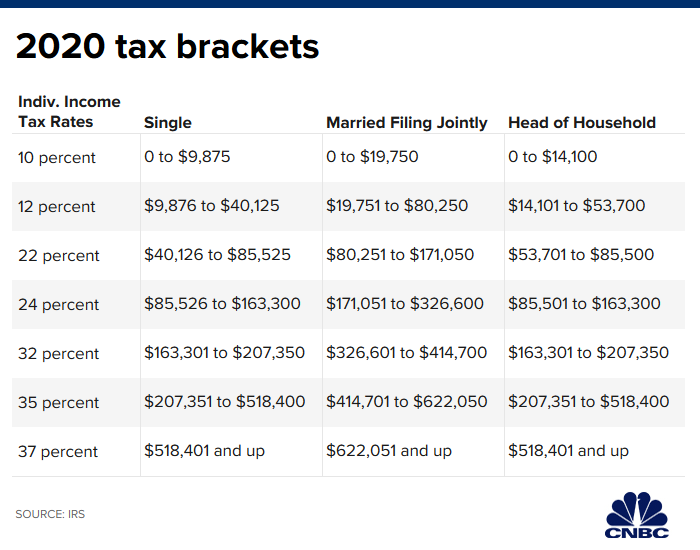

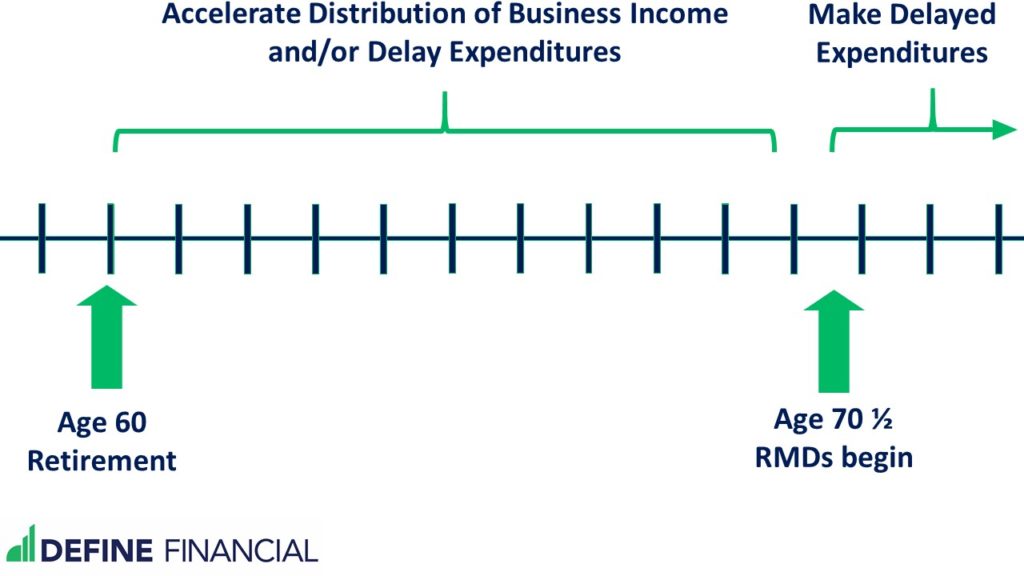

Stash money in your 401 (k) contribute to an ira. Here are 10 options that can help lower your tax bracket: Each category contains seven tax brackets:

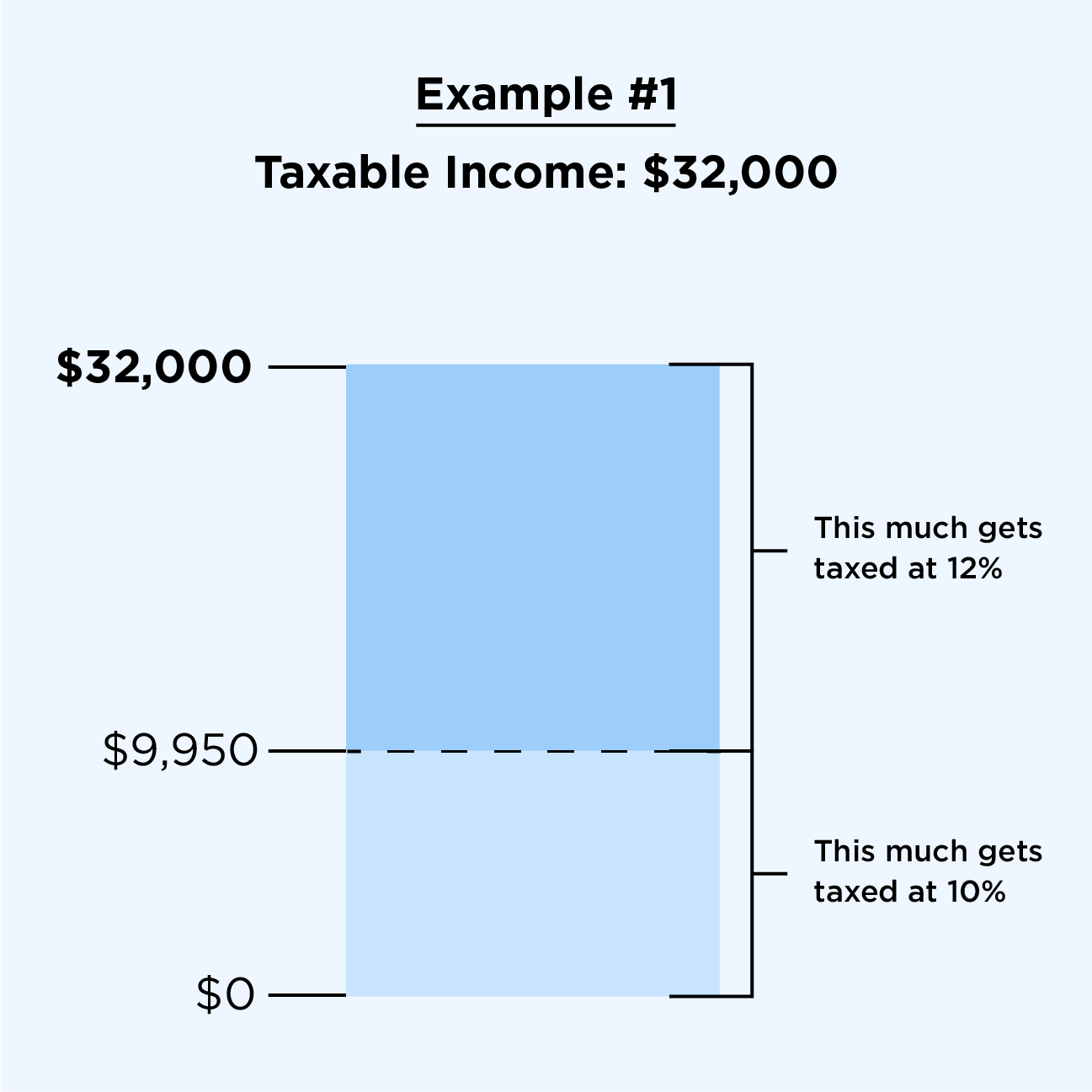

The lowest tax bracket is for filers who earn $9,875 or less — you’ll pay a flat rate of 10%. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone. Certain types of income aren’t subject to income tax at all.

6 ways to lower your. Tie the knot with another taxpayer. In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023.

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. If you got a huge refund, do the opposite and reduce your withholding — otherwise, you could be needlessly living on less of your paycheck all year. Deductions lower your taxable income by the percentage of your highest federal income tax bracket.

How to reduce taxable income # 1 401 (k) contributions. Take advantage of tax credits. Putting money into your traditional ira, 401 (k) plan, or other retirement plan.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

![How Tax Brackets Work [2022 Tax Brackets] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-29-at-9.46.08-AM.png)